______________________________________

______________________________________

BRITISH FIRM: EST FEB 12TH 2018 ______________________________________

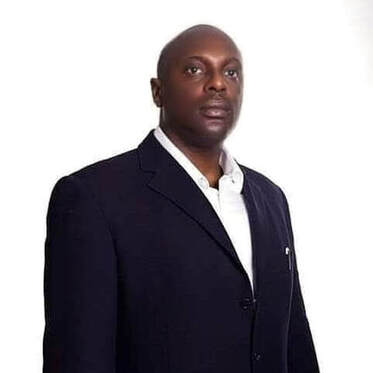

CLEMENT AGHAYERE UK CHAIRMAN

AFRICA BRIDGE CAPITAL MGMT .

BERKELEY SQ MAYFAIR LONDON

GLOBAL HEADOFFICE | BRITISH FIRM

______________________________________

______________________________________

BRITISH FINANCIAL SERVICES UK

______________________________________

______________________________________

~ CONNECTING AFRICA TO THE LONDON CAPITAL MARKETS [ DCM ]

______________________________________

BRITISH FINANCIAL SERVICES INSTITUTION MAYFAIR LONDON ______________________________________

|

|

|

______________________________________

CLEMENT AGHAYERE CHAIRMAN AND CEO , AFRICA BRIDGE CAPITAL MANAGEMENT

LSEG | London stock exchange Group

Investment banking [ work space ] -

LSEG | London stock exchange Group

Investment banking [ work space ] -

______________________________________

Your browser does not support viewing this document. Click here to download the document.

_____________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON [ UK ] LIMITED

GLOBAL INVESTMENT BANKING FIRM MAYFAIR LONDON UK LTD

35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM.

registered in England and Wales, Company number 11201006

partnered with EBURY UK -owned by The Santander Bank The Santander Group

______________________________________________________________________________________________

Leaders of Great Britain - Clement Aghayere [ BRITISH SENIOR BANKER EX BARCLAYS UK PLC, ANTI -MONEY LAUNDERING ]

______________________________________________________________________________________________________________________________

LSEG (London Stock Exchange Group)

Investment banking workspace - British senior - Level banker Ex Barclays Bank anti -money laundering division Clement Aghayere

British Financial Services London, England

_____________________________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON [ UK ] LIMITED

GLOBAL INVESTMENT BANKING FIRM MAYFAIR LONDON UK LTD

35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM.

registered in England and Wales, Company number 11201006

partnered with EBURY UK -owned by The Santander Bank The Santander Group

______________________________________________________________________________________________

Leaders of Great Britain - Clement Aghayere [ BRITISH SENIOR BANKER EX BARCLAYS UK PLC, ANTI -MONEY LAUNDERING ]

______________________________________________________________________________________________________________________________

LSEG (London Stock Exchange Group)

Investment banking workspace - British senior - Level banker Ex Barclays Bank anti -money laundering division Clement Aghayere

British Financial Services London, England

_____________________________________________________________________________________________________________________________________________

Clement Aghayere - The London Investor Show 2023 Click here

British Chief executive Clement Aghayere has been leading Global Investments in to Nigeria and Africa for the the past decade | Mayfair London based banker has raised tens of billions of united states dollars for Investment grade corporations in Nigeria and sub Investment grade corporations across 16 west African sovereign states loan agreements in principle | British Banking family the Aghayere family Mayfair London

British Chief executive Clement Aghayere has been leading Global Investments in to Nigeria and Africa for the the past decade | Mayfair London based banker has raised tens of billions of united states dollars for Investment grade corporations in Nigeria and sub Investment grade corporations across 16 west African sovereign states loan agreements in principle | British Banking family the Aghayere family Mayfair London

______________________________________

BRITISH FINANCIAL SERVICES INSTITUTION MAYFAIR LONDON ______________________________________

Your browser does not support viewing this document. Click here to download the document.

______________________________________________________________________________________________________________________________

BRITISH FINANCIAL SERVICES FIRM : ESTABLISHED FEB 12TH , 2018

______________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT MAYFAIR LONDON [ UK] LTD

BERKELEY SUITE , 35 BERKELEY SQUARE MAYFAIR LONDON W1 J 5BF

LONDON UK GLOBAL HEAD OFFICE: DIRECT LINE + 44 020 7504 7065

______________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON [ UK ] LIMITED

GLOBAL INVESTMENT BANKING FIRM

35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM.

registered in England and Wales, Company number 11201006

_______________________________________________________________________________________________________________________________Global Emerging Markets London, UK (GEM)

_______________________________________________________________________________________________________________________________________________

~ As a UK firm we see the riskiest Bright spots in emerging markets Debt .

______________________________________________________________________________________________

British Born chief executive Clement Aghayere UK Chair and CEO has raised tens of billions of USD for the sovereign Nigeria | an estimated $30bn loan agreements in principle and has closed USD 670 million loans for the No1 credit status in Africa -AFREXIM BANK & GEMCORP UK

BRITISH FINANCIAL SERVICES FIRM : ESTABLISHED FEB 12TH , 2018

______________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT MAYFAIR LONDON [ UK] LTD

BERKELEY SUITE , 35 BERKELEY SQUARE MAYFAIR LONDON W1 J 5BF

LONDON UK GLOBAL HEAD OFFICE: DIRECT LINE + 44 020 7504 7065

______________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON [ UK ] LIMITED

GLOBAL INVESTMENT BANKING FIRM

35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM.

registered in England and Wales, Company number 11201006

_______________________________________________________________________________________________________________________________Global Emerging Markets London, UK (GEM)

_______________________________________________________________________________________________________________________________________________

~ As a UK firm we see the riskiest Bright spots in emerging markets Debt .

______________________________________________________________________________________________

British Born chief executive Clement Aghayere UK Chair and CEO has raised tens of billions of USD for the sovereign Nigeria | an estimated $30bn loan agreements in principle and has closed USD 670 million loans for the No1 credit status in Africa -AFREXIM BANK & GEMCORP UK

______________________________________

______________________________________

BRITISH BANKING | FINANCE FAMILY THE AGHAYERE FAMILY [ UK ] BERKELEY SQ MAYFAIR LONDON

LONDON, THE UNITED KINGDOM

_____________________________________

______________________________________

~ British Principal Founder , Clement Aghayere has raised tens of billions of united states dollars for corporations sovereign Nigeria | loan agreements in principle | British Born private school educated Mayfair London based emerging markets banker is Globally acknowledged as the city of London most successful Africa - focused Investment banker | Clement Aghayere [ British [ is solely responsible for the largest debt capital raise in the history of the city of London for an African corporation | a USD 7Bn [ seven billion united states dollars loan agreement i principle for the No1 corporation in Affric [ DANGOTE REFINERY ] BRITISH BANKING FAMILY MAYFAIR LONDON THE AGHAYERE FAMILY DYNASTY [ THREE GENERATIONS OF BANKING AND FINANCE CITY OF LONDON AND MAIN FINANCIAL CENTRES AROUND THE WORLD . UK

______________________________________

MAYFAIR LONDON BASED FINANCIAL SERVICES FIRM

~ connecting Nigeria and African markets to the London capital markets [ debt capital markets and Equity capital markets ]

______________________________________

GLOBAL TEAM : HIGHLY EXPERIENCED EMERGING MARKETS , AFRICA - FOCUSED BANKERS AND FINANCE PROFESSIONALS

CIRCA . 20 FINANCE PROFESSIONALS WORLD WIDE | CITY OF LONDON , OFFICES - HQ | NEW YORK | LAGOS | DELHI , INDIA .

_____________________________________________________________________________________________________________________________________________

Clement Aghayere, a British senior -Level banker, stands out as one of the most successful emerging markets, Africa-focused investment bankers in The history of The city of London . His impressive track record includes roles at Barclays Bank Plc and as a co-founder of the emerging markets merchant bank Brigg Capital (which was later renamed BriggMACADAM Belgravia in London). During his tenure, he held the position of Senior Vice President for the continent of Africa. Mr. Aghayere has raised tens of billions of United States dollars for corporations and sovereign Nigeria loan agreements in principle . Notably, he has been exclusively mandated as the preferred corporate partner for corporate origination in Africa since 2015 to 2023 for the Bank of China. His current transaction portfolio is estimated at a staggering $30 billion1 2 3. Born in The city of London and graduated in The city of London Mr Clement Aghayere's remarkable ability to successfully close multiple AAA-rated transactions across the African region has led him to become the Chairman and CEO of Africa Bridge Capital Management London UK Limited. Under his leadership, the firm has organically transitioned into the Global No. 1 Fund Arranger and Transaction Advisor for the largest economy in Africa and other selected countries across the continent1 3. His achievements in the world of investment banking are truly commendable, making him a prominent figure in the financial landscape [ BRITISH FINANCIAL SERVICES INSTITUTION BERKELEY SUITE , 35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM

_____________________________________________________________________________________________________________________________________________

Global Emerging Markets London, UK (GEM)

_______________________________________________________________________________________________________________________________________________

~ As a UK firm we see the riskiest Bright spots in emerging markets Debt .

_____________________________________________________________________________________________________________________________________________

CLEMENT AGHAYERE UK CHAIRMAN | successfully closed USD 315M loans | secured agreements in principle USD 30BN, AUM - for Nigeria ,

The UK , most well respected Investment banking platform London The United Kingdom | AFRICA BRIDGE CAPITAL MANAGEMENT LONDON

_______________________________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LTD, a UK registered advisory firm with Company registration number 11201006 with its registered of office 35 Berkeley square Mayfair London w1 (hereinafter referred to as “Africa Bridge” )Mayfair London - based British corporate banker and emerging markets senior Investment Banker Mr Clement Aghayere | BRITISH FOUNDNG PARTNER

_____________________________________________________________________________________________________________________________________________

corporate capital raising mandate 2024 | USD 1bn - NNPL SPV | AFRICA BRIDGE CAPITAL MANAGEMENT UK LTD AND OCTAVE PARTNERS | British senior - level Banker Clement Aghayere EMEA CEO at Africa Bridge capital management London was Formerly Co - Founder | Partner and VP Africa at Emerging Markets Merchant Bank Brigg Capital Mayfair London renamed BriggMacadam Investment Bank Belgravia London | an exit that saw the firm lose it's biggest "RAINMAKER " - superstar emerging markets , Africa - focused investment banker based city of London | London The United kingdom has since founded in Feb 2018 , Africa bridge capital management London United Kingdom

Mayfair London - based Global banker Clement Aghayere [ Ex Barclays Bank UK PLC ] has secured a USD 250 million united states dollars ] loan agreement in principle for DANGOTE REFINERY PROJECT - The largest corporate in Africa Afrexim Bank closed USD 300 million | Clement Aghayere secured , 1st tranche of Billion corporate capital raising mandate exclusive to the debt capital markets - China | AFREXIM BANK is The No1 preferred credit status on the entire continent of Africa region .

CIRCA . 20 FINANCE PROFESSIONALS WORLD WIDE | CITY OF LONDON , OFFICES - HQ | NEW YORK | LAGOS | DELHI , INDIA .

_____________________________________________________________________________________________________________________________________________

Clement Aghayere, a British senior -Level banker, stands out as one of the most successful emerging markets, Africa-focused investment bankers in The history of The city of London . His impressive track record includes roles at Barclays Bank Plc and as a co-founder of the emerging markets merchant bank Brigg Capital (which was later renamed BriggMACADAM Belgravia in London). During his tenure, he held the position of Senior Vice President for the continent of Africa. Mr. Aghayere has raised tens of billions of United States dollars for corporations and sovereign Nigeria loan agreements in principle . Notably, he has been exclusively mandated as the preferred corporate partner for corporate origination in Africa since 2015 to 2023 for the Bank of China. His current transaction portfolio is estimated at a staggering $30 billion1 2 3. Born in The city of London and graduated in The city of London Mr Clement Aghayere's remarkable ability to successfully close multiple AAA-rated transactions across the African region has led him to become the Chairman and CEO of Africa Bridge Capital Management London UK Limited. Under his leadership, the firm has organically transitioned into the Global No. 1 Fund Arranger and Transaction Advisor for the largest economy in Africa and other selected countries across the continent1 3. His achievements in the world of investment banking are truly commendable, making him a prominent figure in the financial landscape [ BRITISH FINANCIAL SERVICES INSTITUTION BERKELEY SUITE , 35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM

_____________________________________________________________________________________________________________________________________________

Global Emerging Markets London, UK (GEM)

_______________________________________________________________________________________________________________________________________________

~ As a UK firm we see the riskiest Bright spots in emerging markets Debt .

_____________________________________________________________________________________________________________________________________________

CLEMENT AGHAYERE UK CHAIRMAN | successfully closed USD 315M loans | secured agreements in principle USD 30BN, AUM - for Nigeria ,

The UK , most well respected Investment banking platform London The United Kingdom | AFRICA BRIDGE CAPITAL MANAGEMENT LONDON

_______________________________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LTD, a UK registered advisory firm with Company registration number 11201006 with its registered of office 35 Berkeley square Mayfair London w1 (hereinafter referred to as “Africa Bridge” )Mayfair London - based British corporate banker and emerging markets senior Investment Banker Mr Clement Aghayere | BRITISH FOUNDNG PARTNER

_____________________________________________________________________________________________________________________________________________

corporate capital raising mandate 2024 | USD 1bn - NNPL SPV | AFRICA BRIDGE CAPITAL MANAGEMENT UK LTD AND OCTAVE PARTNERS | British senior - level Banker Clement Aghayere EMEA CEO at Africa Bridge capital management London was Formerly Co - Founder | Partner and VP Africa at Emerging Markets Merchant Bank Brigg Capital Mayfair London renamed BriggMacadam Investment Bank Belgravia London | an exit that saw the firm lose it's biggest "RAINMAKER " - superstar emerging markets , Africa - focused investment banker based city of London | London The United kingdom has since founded in Feb 2018 , Africa bridge capital management London United Kingdom

Mayfair London - based Global banker Clement Aghayere [ Ex Barclays Bank UK PLC ] has secured a USD 250 million united states dollars ] loan agreement in principle for DANGOTE REFINERY PROJECT - The largest corporate in Africa Afrexim Bank closed USD 300 million | Clement Aghayere secured , 1st tranche of Billion corporate capital raising mandate exclusive to the debt capital markets - China | AFREXIM BANK is The No1 preferred credit status on the entire continent of Africa region .

- Gemcorp UK - successfully closed USD 335 Million AFREXIMBANK | AFC | GEMCORP UK - Cabinda refinery project Angola | Joint mandate restorium and Africa bridge capital management 35 Berkeley square Mayfair London secured USD 50 million for and on behalf of GEMCORP UK .

- Barak Fund management - mandated USD 800 million - Clement Aghayere CEO , corporate capital raising mandate mandate 2023

- NNPCL - AFREXIMBANK SPV - USD 1 billion - Joint mandate - Africa bridge capital management and Octave Partners 2O24

- Africa bridge capital management and Ebury UK successfully closed corporate FX transactions with Global wheat trading company and an Africa focused Global emerging markets Fund

- Mayfair London - based Global banker Clement Aghayere [ Ex Barclays Bank UK PLC ] has secured a USD 7bn [ seven billion united states dollars ] loan agreement in principle for DANGOTE REFINERY PROJECT - The largest corporation in Africa .

- Mayfair London - based Global banker Clement Aghayere [ Ex Barclays Bank UK PLC ] has secured a USD 250 million united states dollars ] loan agreement in principle for DANGOTE CEMENT PLC The largest corporation in Africa - expansion projects across West Africa

- Mayfair London - based Global banker Clement Aghayere [ Ex Barclays Bank UK PLC ] has secured a USD 2 BN [ Two Billion united states dollars ] loan agreement in principle for ONELNG one of the - The largest LNG companies in corporate in Africa

- Mayfair London - based Global banker Clement Aghayere [ Ex Barclays Bank UK PLC ] has secured a USD 2.5 BN [ Two Hundred Billion and five hundred million united states ] dollars ] loan agreement in principle for AITEO Group - one of the The largest oil and Gas gas corporations in corporate in Africa

- Mayfair London - based Global banker Clement Aghayere [ Ex Barclays Bank UK PLC ] has secured a USD 2 BN [ Two Billion united states dollars ] loan agreement in principle for The corporation ONELNG London The United Kingdom one of the - The largest LNG companies in corporate in Africa

- Mayfair London - based Global banker Clement Aghayere [ Ex Barclays Bank UK PLC ] has secured a USD 2.5 BN [ Two Hundred Billion and five hundred million united states ] dollars ] loan agreement in principle for AITEO Group - one of the The largest oil and Gas corporations / corporates in Nigeria

______________________________________

UK - BASED FINANCIAL SERVICES INSTITUTION MAYFAIR LONDON

______________________________________

_____________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON [ UK ] LIMITED

GLOBAL INVESTMENT BANKING FIRM MAYFAIR LONDON UK LTD

35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM.

registered in England and Wales, Company number 11201006

____________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON [ UK ] LIMITED

GLOBAL INVESTMENT BANKING FIRM MAYFAIR LONDON UK LTD

35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM.

registered in England and Wales, Company number 11201006

____________________________________________________________________________________________

Your browser does not support viewing this document. Click here to download the document.

______________________________________

GLOBAL EMERGING MARKETS

INVESTMENT BANKING LONDON

______________________________________

EMEA CEO CLEMENT AGHAYERE

EM PORTFOLIO USD 30BN AUM

______________________________________

- British financial services firm has secured an estimated USD 30BN loan agreements in principle since inception Feb 12th 2018 - transactions in Nigeria & across Africa sub region

_______________________________________________________________________

Your browser does not support viewing this document. Click here to download the document.

_______________________________________________________________________________________________________________________________

GLOBAL TEAM : HIGHLY EXPERIENCED EMERGING MARKETS , AFRICA - FOCUSED BANKERS AND FINANCE PROFESSIONALS

CIRCA . 20 FINANCE PROFESSIONALS WORLD WIDE | CITY OF LONDON , OFFICES - HQ | NEW YORK | LAGOS | DELHI , INDIA .

_____________________________________________________________________________________________________________________________

Clement Aghayere, a British senior banker, stands out as one of the most successful emerging markets, Africa-focused investment bankers. His impressive track record includes roles at Barclays Bank Plc and as a co-founder of the emerging markets merchant bank Brigg Capital (which was later renamed BriggMACADAM Belgravia in London). During his tenure, he held the position of Senior Vice President for the continent of Africa. Mr. Aghayere has raised tens of billions of United States dollars for corporations and sovereign Nigeria. Notably, he has been exclusively mandated as the preferred corporate partner for corporate origination in Africa since 2015 to 2023 for the Bank of China. His current transaction portfolio is estimated at a staggering $30 billion1 2 3. Born in The city of London and graduated in The city of London Mr Clement Aghayere's remarkable ability to successfully close multiple AAA-rated transactions across the African region has led him to become the Chairman and CEO of Africa Bridge Capital Management London UK Limited. Under his leadership, the firm has organically transitioned into the Global No. 1 Fund Arranger and Transaction Advisor for the largest economy in Africa and other selected countries across the continent1 3. His achievements in the world of investment banking are truly commendable, making him a prominent figure in the financial landscape [ BRITISH FINANCIAL SERVICES INSTITUTION BERKELEY SUITE , 35 BERKLEEY SQUARE MAYFAIR LONDON TH EUNTED KINGDOM

GLOBAL TEAM : HIGHLY EXPERIENCED EMERGING MARKETS , AFRICA - FOCUSED BANKERS AND FINANCE PROFESSIONALS

CIRCA . 20 FINANCE PROFESSIONALS WORLD WIDE | CITY OF LONDON , OFFICES - HQ | NEW YORK | LAGOS | DELHI , INDIA .

_____________________________________________________________________________________________________________________________

Clement Aghayere, a British senior banker, stands out as one of the most successful emerging markets, Africa-focused investment bankers. His impressive track record includes roles at Barclays Bank Plc and as a co-founder of the emerging markets merchant bank Brigg Capital (which was later renamed BriggMACADAM Belgravia in London). During his tenure, he held the position of Senior Vice President for the continent of Africa. Mr. Aghayere has raised tens of billions of United States dollars for corporations and sovereign Nigeria. Notably, he has been exclusively mandated as the preferred corporate partner for corporate origination in Africa since 2015 to 2023 for the Bank of China. His current transaction portfolio is estimated at a staggering $30 billion1 2 3. Born in The city of London and graduated in The city of London Mr Clement Aghayere's remarkable ability to successfully close multiple AAA-rated transactions across the African region has led him to become the Chairman and CEO of Africa Bridge Capital Management London UK Limited. Under his leadership, the firm has organically transitioned into the Global No. 1 Fund Arranger and Transaction Advisor for the largest economy in Africa and other selected countries across the continent1 3. His achievements in the world of investment banking are truly commendable, making him a prominent figure in the financial landscape [ BRITISH FINANCIAL SERVICES INSTITUTION BERKELEY SUITE , 35 BERKLEEY SQUARE MAYFAIR LONDON TH EUNTED KINGDOM

______________________________________

Africa Bridge Capital Management London

35 Berkeley Square Mayfair London W1J 5BF

London Global head office020 7504 7065

Clement Aghayere - The London Investor Show 2023 Click here

_____________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT MAYFAIR LONDON UK LTD

35 BERKELEY SQUARE MAYFAIR LONDON

GLOBAL HEAD OFFICE : DIRECT LINE + 44 020 7504 7065

_____________________________________________________________________________________________________________________________

35 Berkeley Square Mayfair London W1J 5BF

London Global head office020 7504 7065

Clement Aghayere - The London Investor Show 2023 Click here

_____________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT MAYFAIR LONDON UK LTD

35 BERKELEY SQUARE MAYFAIR LONDON

GLOBAL HEAD OFFICE : DIRECT LINE + 44 020 7504 7065

_____________________________________________________________________________________________________________________________

Your browser does not support viewing this document. Click here to download the document.

_____________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON [ UK ] LIMITED

GLOBAL INVESTMENT BANKING FIRM MAYFAIR LONDON UK LTD

35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM.

registered in England and Wales, Company number 11201006

_____________________________________________________________________________________________

~ Described as - The Lazard of Africa -

______________________________________________________________________________________________________________________________

UK - BASED FINANCIAL SERVICES INSTITUTION MAYFAIR LONDON.

_____________________________________________________________________________________________________________________________

GLOBAL TEAM : HIGHLY EXPERIENCED EMERGING MARKETS , AFRICA - FOCUSED BANKERS AND FINANCE PROFESSIONALS

CIRCA . 20 FINANCE PROFESSIONALS WORLD WIDE | CITY OF LONDON , OFFICES - HQ | NEW YORK | LAGOS | DELHI , INDIA .

______________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT | BERKELEY SUITE 35 BERKELEY SQUARE MAYFAIR LONDON is one of the world’s leading full-service investment banking firms entirely focused on Africa and Global capital markets firm, Mayfair London The UK

_________________________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANGEMENT 35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM | has secured since inception thirty billion united states dollars USD 30BN for Investment grade corporations in Nigeria loan agreements in principle | British financial services institution is owned 100 % by British senior banker Clement Aghayere Ex - Barclays Bank UK PLC anti money laundering division city of London

corporate capital raising mandate 2024 | USD 1bn - NNPL SPV | AFRICA BRIDGE CAPITAL MANAGEMENT UK LTD AND OCTAVE PARTNERS | British senior - level Banker Clement Aghayere EMEA CEO at Africa Bridge capital management London was Formerly Co - Founder | Partner and VP Africa at Emerging Markets Merchant Bank Brigg Capital Mayfair London renamed BriggMacadam Investment Bank Belgravia London | an exit that saw the firm lose it's biggest "RAINMAKER " - superstar emerging markets , Africa - focused investment banker based in the city of London | London The United kingdom has since founded in Feb 2018 , Africa bridge capital management Mayfair London UK

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON [ UK ] LIMITED

GLOBAL INVESTMENT BANKING FIRM MAYFAIR LONDON UK LTD

35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM.

registered in England and Wales, Company number 11201006

_____________________________________________________________________________________________

~ Described as - The Lazard of Africa -

______________________________________________________________________________________________________________________________

UK - BASED FINANCIAL SERVICES INSTITUTION MAYFAIR LONDON.

_____________________________________________________________________________________________________________________________

GLOBAL TEAM : HIGHLY EXPERIENCED EMERGING MARKETS , AFRICA - FOCUSED BANKERS AND FINANCE PROFESSIONALS

CIRCA . 20 FINANCE PROFESSIONALS WORLD WIDE | CITY OF LONDON , OFFICES - HQ | NEW YORK | LAGOS | DELHI , INDIA .

______________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT | BERKELEY SUITE 35 BERKELEY SQUARE MAYFAIR LONDON is one of the world’s leading full-service investment banking firms entirely focused on Africa and Global capital markets firm, Mayfair London The UK

_________________________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANGEMENT 35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM | has secured since inception thirty billion united states dollars USD 30BN for Investment grade corporations in Nigeria loan agreements in principle | British financial services institution is owned 100 % by British senior banker Clement Aghayere Ex - Barclays Bank UK PLC anti money laundering division city of London

corporate capital raising mandate 2024 | USD 1bn - NNPL SPV | AFRICA BRIDGE CAPITAL MANAGEMENT UK LTD AND OCTAVE PARTNERS | British senior - level Banker Clement Aghayere EMEA CEO at Africa Bridge capital management London was Formerly Co - Founder | Partner and VP Africa at Emerging Markets Merchant Bank Brigg Capital Mayfair London renamed BriggMacadam Investment Bank Belgravia London | an exit that saw the firm lose it's biggest "RAINMAKER " - superstar emerging markets , Africa - focused investment banker based in the city of London | London The United kingdom has since founded in Feb 2018 , Africa bridge capital management Mayfair London UK

______________________________________

____________________________________________________________________________________________________________________________________________

Global transaction banking Berkeley square Mayfair London .

made simple. Ebury Solution & Africa bridge capital management

35 Berkeley Square Mayfair London | Global No1 Liquidity provider/s corporate FX for Nigeria and the continent of Africa | emerging markets

.______________________________________________________________________________________________________________________________________________

Global transaction banking Berkeley square Mayfair London .

made simple. Ebury Solution & Africa bridge capital management

35 Berkeley Square Mayfair London | Global No1 Liquidity provider/s corporate FX for Nigeria and the continent of Africa | emerging markets

.______________________________________________________________________________________________________________________________________________

______________________________________

______________________________________

______________________________________

______________________________________

MR CLEMENT AGHAYERE EMEA CEO

FOUNDER/ OWNER / UK CHAIRMAN.

BRITISH BANKER EX BARCLAYS PLC

______________________________________

______________________________________________________________________

GLOBAL HEAD OFFICE MAYFAIR LONDON UK | : + 44 020 7504 7065

______________________________________________________________________

British by Birth | Clement Aghayere is a British senior level Banker | C.I.B : British corporate and Investment banker city of London [ 27 years ]

Clement Aghayere - The London Investor Show 2023 Click here

Clement Aghayere - AFSIC 2023 - Investing in Africa click here

Gallery – 2017 World Oil & Gas Week | Energy Council Click here

_____________________________________________________________________________________________________________________________

Clement Aghayere | Former Partner and senior Vice President for Africa at emerging markets merchant Bank Brigg Capital Mayfair London 10 Brick Street Mayfair London formerly situated at Helios Investment Partners 2nd Floor, 12 Charles II Street, St James's, London, SW1Y 4Q | UK

_____________________________________________________________________________________________________________________________________________

BRITISH SENIOR LEVEL BANKER EX BARCLAYS UK PLC CLEMENT AGHAYERE GLOBAL SPEAKER LONDON INVESTORS SHOW 2022

______________________________________________________________________________________________________________________________________________

GLOBAL HEAD OFFICE MAYFAIR LONDON UK | : + 44 020 7504 7065

______________________________________________________________________

British by Birth | Clement Aghayere is a British senior level Banker | C.I.B : British corporate and Investment banker city of London [ 27 years ]

Clement Aghayere - The London Investor Show 2023 Click here

Clement Aghayere - AFSIC 2023 - Investing in Africa click here

Gallery – 2017 World Oil & Gas Week | Energy Council Click here

_____________________________________________________________________________________________________________________________

Clement Aghayere | Former Partner and senior Vice President for Africa at emerging markets merchant Bank Brigg Capital Mayfair London 10 Brick Street Mayfair London formerly situated at Helios Investment Partners 2nd Floor, 12 Charles II Street, St James's, London, SW1Y 4Q | UK

_____________________________________________________________________________________________________________________________________________

BRITISH SENIOR LEVEL BANKER EX BARCLAYS UK PLC CLEMENT AGHAYERE GLOBAL SPEAKER LONDON INVESTORS SHOW 2022

______________________________________________________________________________________________________________________________________________

Your browser does not support viewing this document. Click here to download the document.

_____________________________________________________________________________________________________________________________

INVESTMENTS INTO AFRICA REGION

_______________________________________________

INVESTMENTS INTO AFRICA REGION

_______________________________________________

~ Described as - The Lazard of Africa -

_______________________________________________________________________

FUND ARRANGERS AND TRANSACTION ADVISORS FOR INVESTMENT GRADE CORPORATES IN SPECIFICALLY NIGERIA AND SELECTED COUNTRIES ACROSS THE AFRICA REGION : bank debt/ senior loans, second-lien debt, uni tranche debt, mezzanine debt and structured equity for a variety of situations, including growth capital, acquisition financing, refinancing , repricing's, dividend recapitalizations | special situations | Investment grade corporations | African Sovereigns and African Central Banks

____________________________________________________________________________________________________________________________

_______________________________________________________________________

FUND ARRANGERS AND TRANSACTION ADVISORS FOR INVESTMENT GRADE CORPORATES IN SPECIFICALLY NIGERIA AND SELECTED COUNTRIES ACROSS THE AFRICA REGION : bank debt/ senior loans, second-lien debt, uni tranche debt, mezzanine debt and structured equity for a variety of situations, including growth capital, acquisition financing, refinancing , repricing's, dividend recapitalizations | special situations | Investment grade corporations | African Sovereigns and African Central Banks

____________________________________________________________________________________________________________________________

______________________________________ ~ Described as - The Lazard of Africa - Est . FEB 12TH 2018 _____________________________________

UK -BASED FINANCIAL SERVICES INSTITUTION MAYFAIR LONDON

35 BERKELEY SQUARE MAYFAIR LONDON THE UNITED KINGDOM .

______________________________________

GLOBAL

EMERGING MARKETS

INVESTMENT BANKING FIRM

MAYFAIR LONDON THE UNITED KINGDOM.

_______________________________________________

INVESTMENTS INTO AFRICA REGION

______________________________________ REGIONAL NETWORKS

Africa Network

Asia Network

Europe Network

Latin America & The Caribbean Network

Middle East & Gulf States Network

North America Network

______________________________________________________________________

Your browser does not support viewing this document. Click here to download the document.

Your browser does not support viewing this document. Click here to download the document.

______________________________________

British Born Chief executive Clement Aghayere corporation origination LSEG [ un - official mandate ]

_____________________________________________________________________________________________________________________________

GLOBAL NO1

CONNECTING AFRICAN CORPORATIONS TO THE LONDON CAPITAL MARKETS | MAYFAIR LDN

______________________________________________________________________________________________

Ex - Barclays UK PLC anti money laundering division city of London Clement Aghayere UK Chair, Africa bridge capital management London

appointed Aug 2023 senior trade finance consultant at EUROEXIMBANK

Euro Exim Bank | Home Click here

Recently Structured Transactions - EURO EXIM BANK (gitbook.io) Click here

British founders | British Banking Family The Aghayere Family [ UK ] 35 Berkeley square Mayfair London W1J 5BF | + 44 0207 504 7065 [ UK ]

_____________________________________________________________________________________________________________________________________________

BRITISH FOUNDER MR CLEMENT AGHAYERE | GLOBAL CHAIR , BOARD OF DIRECTORS AFRICA BRIDGE CAPITAL MANAGEMENT 35 BERKELEY SQUARE MAYFAIR LONDON W1 J 5BF | Group Chairman Investment banking Europe | Middle east and Africa | British senior -level banker Ex - Barclays Bank UK PLC anti -money laundering division | an emerging markets debt product market specialist debt capital markets China | has raised tens of billions of united states dollars for Investment grade corporations in the sovereign Nigeria [ loan agreements in principle ] Closed USD 300million for AFREXIMBANK | CLOSED USD 335million for GEMCORP UK | CLOSED USD 15million for Zoomay marine

_____________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________

GLOBAL NO1

CONNECTING AFRICAN CORPORATIONS TO THE LONDON CAPITAL MARKETS | MAYFAIR LDN

______________________________________________________________________________________________

Ex - Barclays UK PLC anti money laundering division city of London Clement Aghayere UK Chair, Africa bridge capital management London

appointed Aug 2023 senior trade finance consultant at EUROEXIMBANK

Euro Exim Bank | Home Click here

Recently Structured Transactions - EURO EXIM BANK (gitbook.io) Click here

British founders | British Banking Family The Aghayere Family [ UK ] 35 Berkeley square Mayfair London W1J 5BF | + 44 0207 504 7065 [ UK ]

_____________________________________________________________________________________________________________________________________________

BRITISH FOUNDER MR CLEMENT AGHAYERE | GLOBAL CHAIR , BOARD OF DIRECTORS AFRICA BRIDGE CAPITAL MANAGEMENT 35 BERKELEY SQUARE MAYFAIR LONDON W1 J 5BF | Group Chairman Investment banking Europe | Middle east and Africa | British senior -level banker Ex - Barclays Bank UK PLC anti -money laundering division | an emerging markets debt product market specialist debt capital markets China | has raised tens of billions of united states dollars for Investment grade corporations in the sovereign Nigeria [ loan agreements in principle ] Closed USD 300million for AFREXIMBANK | CLOSED USD 335million for GEMCORP UK | CLOSED USD 15million for Zoomay marine

_____________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________

BRITISH EXECUTIVE CHAIRMAN AND CEO | MR CLEMENT AGHAYERE [ AFRICAN INVESTMENT GRADE CORPORATE CLIENTS INCLUDE ]

______________________________________________________________________________________________________________________________________________

1. AFREXIMBANK CAIRO [ No1 preferred credit status on the continent of Africa ] - FINANCIAL CLOSED USD 300millon

2. DANGOTE REFINERY NIGERIA

3. DANGOTE CEMENT NIGERIA AND ACROSS WEST AFRICA

4. NLNG [ NIGERIAN LNG ] westminster London

5. ONELNG VICTORIA STREET LONDON

6. AITEO LAGOS NIGERIA

7. BARAK FUND MAURITIUS

8. ALTEIA FUND MAURITIUS

9. WEMPCO LAGOS NIGERIA

10. PETROBRAS - PROJECT DIVESTMENTS OIL ASSETS NIGERIA

11. GEMCORP UK - CABINDA REFINERY FINANCIAL CLOSE JULY 2013 USD 335million

BRITISH EXECUTIVE CHAIRMAN AND CEO | MR CLEMENT AGHAYERE [ AFRICAN INVESTMENT GRADE CORPORATE CLIENTS INCLUDE ]

______________________________________________________________________________________________________________________________________________

1. AFREXIMBANK CAIRO [ No1 preferred credit status on the continent of Africa ] - FINANCIAL CLOSED USD 300millon

2. DANGOTE REFINERY NIGERIA

3. DANGOTE CEMENT NIGERIA AND ACROSS WEST AFRICA

4. NLNG [ NIGERIAN LNG ] westminster London

5. ONELNG VICTORIA STREET LONDON

6. AITEO LAGOS NIGERIA

7. BARAK FUND MAURITIUS

8. ALTEIA FUND MAURITIUS

9. WEMPCO LAGOS NIGERIA

10. PETROBRAS - PROJECT DIVESTMENTS OIL ASSETS NIGERIA

11. GEMCORP UK - CABINDA REFINERY FINANCIAL CLOSE JULY 2013 USD 335million

______________________________________

______________________________________

CLEMENT AGHAYERE UK CHAIRMAN

BRITISH BANKER EX BARCLAYS PLC

FORMER PARTNER | VP EMERGING MARKETS AFRICA MERCHANT BANK

BRIGG CAPITAL MAYFAIR LONDON COMMERCIAL REPRESENTATIVE AND PREFERRED CORPORATE PARTNER FOR CONTINENT AFRICA AT BANK OF CHINA GROUP LIMITED.

STRATEGIC PARTNER EBURY [ UK ]

OWNED BY THE SANTANDER BANK

THE SANTANDER GROUP LONDON

BRITISH FINANCIAL SERVICES [ UK ]

APPOINTED AUG 2023 | UK GLOBAL MANAGING DIRECTOR TRADE FIANNCE SENIOR CONSULTANT EURO EXIM BANK [ BRITISH FIRM ]

______________________________________

Your browser does not support viewing this document. Click here to download the document.

______________________________________________________________________________________________________________________________________________________________________________~ Described as - The Lazard of Africa -

_______________________________________________________________________

FUND ARRANGERS AND TRANSACTION ADVISORS FOR INVESTMENT GRADE CORPORATES IN SPECIFICALLY NIGERIA AND SELECTED COUNTRIES ACROSS THE AFRICA REGION : bank debt/ senior loans, second-lien debt, uni tranche debt, mezzanine debt and structured equity for a variety of situations, including growth capital, acquisition financing, refinancing , repricing's, dividend recapitalizations | special situations | Investment grade corporations | African Sovereigns and African Central Banks

____________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON UK LIMITED | led by British Banker Ex -Barclays Bank PLC ,city of London | Anti-money laundering division | MR CLEMENT AGHAYERE Chairman and CEO, and a senior management team composed of elite managers, and seasoned emerging markets finance professionals and Investment bankers each with 20-plus years of city of London | Ex -state Bank of India | Ex Standard Chartered | Ex - AFREXIM BANK | Former Chairman Chevron Nigeria for Africa and Latin America experiences hailing from top tier Global financial institutions. Clement, was former Co-Founder emerging markets merchant Bank Brigg Capital renamed BriggMACADAM Investment bank London | Clement has been exclusively mandated as preferred corporate partner for corporate origination Africa since 2015 - 2023 for the BANK OF CHINA | BANK OF CHINA GROUP LTD 中国银行股份有限公 | Clement, is the most successful Africa banker in the world

_____________________________________________________________________________________________________________________________________________

_______________________________________________________________________

FUND ARRANGERS AND TRANSACTION ADVISORS FOR INVESTMENT GRADE CORPORATES IN SPECIFICALLY NIGERIA AND SELECTED COUNTRIES ACROSS THE AFRICA REGION : bank debt/ senior loans, second-lien debt, uni tranche debt, mezzanine debt and structured equity for a variety of situations, including growth capital, acquisition financing, refinancing , repricing's, dividend recapitalizations | special situations | Investment grade corporations | African Sovereigns and African Central Banks

____________________________________________________________________________________________________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON UK LIMITED | led by British Banker Ex -Barclays Bank PLC ,city of London | Anti-money laundering division | MR CLEMENT AGHAYERE Chairman and CEO, and a senior management team composed of elite managers, and seasoned emerging markets finance professionals and Investment bankers each with 20-plus years of city of London | Ex -state Bank of India | Ex Standard Chartered | Ex - AFREXIM BANK | Former Chairman Chevron Nigeria for Africa and Latin America experiences hailing from top tier Global financial institutions. Clement, was former Co-Founder emerging markets merchant Bank Brigg Capital renamed BriggMACADAM Investment bank London | Clement has been exclusively mandated as preferred corporate partner for corporate origination Africa since 2015 - 2023 for the BANK OF CHINA | BANK OF CHINA GROUP LTD 中国银行股份有限公 | Clement, is the most successful Africa banker in the world

_____________________________________________________________________________________________________________________________________________

______________________________________

EMERGING MARKETS

INVESTMENT BANKING FIRM

CITY OF LONDON THE UNITED KINGDOM.

_______________________________________________

Global Emerging Markets London, UK (GEM)

_______________________________________________________________________________________________________________________________________________

~ As a UK firm we see the riskiest Bright spots in emerging markets Debt .

______________________________________________________________________________________________

Global Emerging Markets London, UK (GEM)

_______________________________________________________________________________________________________________________________________________

~ As a UK firm we see the riskiest Bright spots in emerging markets Debt .

______________________________________________________________________________________________

Financial advisory

Africa bridge capital Management London UK [ Head office ] advises African clients on a wide range of strategic and financial issues. These may include advising on the potential acquisition of another company, business or certain assets, or on the sale of certain businesses, assets or an entire company. The firm also advises on alternatives to a sale such as recapitalizations, spin-offs, carve-outs and split-offs. For companies in financial distress or their creditors, Africa bridge capital Management London Head office - advises on all aspects of restructuring. The firm has advised on many of the largest restructuring assignments in the wake of the global financial crisis that began in mid-2020 Africa bridge capital Management London also advises on capital structure and capital raising. Capital structure advice includes reviewing and analysing structural alternatives and assisting in long-term planning. Capital raising advice includes private and public market financing. Africa bridge Capital Management London Sovereign Advisory group advises African governments | African sovereign entities on African policy and financial issues

Africa bridge capital Management London UK [ Head office ] advises African clients on a wide range of strategic and financial issues. These may include advising on the potential acquisition of another company, business or certain assets, or on the sale of certain businesses, assets or an entire company. The firm also advises on alternatives to a sale such as recapitalizations, spin-offs, carve-outs and split-offs. For companies in financial distress or their creditors, Africa bridge capital Management London Head office - advises on all aspects of restructuring. The firm has advised on many of the largest restructuring assignments in the wake of the global financial crisis that began in mid-2020 Africa bridge capital Management London also advises on capital structure and capital raising. Capital structure advice includes reviewing and analysing structural alternatives and assisting in long-term planning. Capital raising advice includes private and public market financing. Africa bridge Capital Management London Sovereign Advisory group advises African governments | African sovereign entities on African policy and financial issues

______________________________________

Your browser does not support viewing this document. Click here to download the document.

GLOBAL MEDIA CITY OF LONDON THE UNITED KINGDOM

CLEMENT AGHAYERE | EMEA CEO , AFRICA BRIDGE CAPITAL MANAGEMENT LONDON THE UNITED KINGDOM .

______________________________________________________________________________________________________________________________

Clement Aghayere - The London Investor Show 2022 [ Click here ]

Speakers - London Investor Show - The London Investor Show 2022 [ Click here ]

Gallery – 2017 World Oil & Gas Week | Energy Council

Gallery – 2017 WOGW Awards | Energy Council [ Click here ]

Our Team (torinocap.com) [ Click here ]Invest in Africa (invest-in-africa.co) [ Click here ]

中国银行全球服务 Always with you @ 英国 United Kingdom (bankofchina.com)

Our Team – Empire Capital (empirecapitalfund.org) [ Click here ]

REUTERS REPORTS EXCLUSIVE Shell's Nigerian oil assets attract interest from local firms, sources say [ Click here ]

Clement Aghayere mandated Jan 2022 | $2.3bn Shell divestment Nigeria corporate capital raising mandate, this is the biggest transaction in Africa today , This single transaction is responsible for 39% of Nigeria's oil production | British born , private school educated city of London EM, Africa Investment banker stems from the most successful banking family Africa responsible for the largest M & A transactions continent Africa

CLEMENT AGHAYERE | EMEA CEO , AFRICA BRIDGE CAPITAL MANAGEMENT LONDON THE UNITED KINGDOM .

______________________________________________________________________________________________________________________________

Clement Aghayere - The London Investor Show 2022 [ Click here ]

Speakers - London Investor Show - The London Investor Show 2022 [ Click here ]

Gallery – 2017 World Oil & Gas Week | Energy Council

Gallery – 2017 WOGW Awards | Energy Council [ Click here ]

Our Team (torinocap.com) [ Click here ]Invest in Africa (invest-in-africa.co) [ Click here ]

中国银行全球服务 Always with you @ 英国 United Kingdom (bankofchina.com)

Our Team – Empire Capital (empirecapitalfund.org) [ Click here ]

REUTERS REPORTS EXCLUSIVE Shell's Nigerian oil assets attract interest from local firms, sources say [ Click here ]

Clement Aghayere mandated Jan 2022 | $2.3bn Shell divestment Nigeria corporate capital raising mandate, this is the biggest transaction in Africa today , This single transaction is responsible for 39% of Nigeria's oil production | British born , private school educated city of London EM, Africa Investment banker stems from the most successful banking family Africa responsible for the largest M & A transactions continent Africa

______________________________________

______________________________________________________________________________________________________________________________________________________________________________~ Described as - The Lazard of Africa -

_______________________________________________________________________

FUND ARRANGERS AND TRANSACTION ADVISORS FOR INVESTMENT GRADE CORPORATES IN SPECIFICALLY NIGERIA AND SELECTED COUNTRIES ACROSS THE AFRICA REGION : bank debt/ senior loans, second-lien debt, uni tranche debt, mezzanine debt and structured equity for a variety of situations, including growth capital, acquisition financing, refinancing , repricing's, dividend recapitalizations | special situations | Investment grade corporations | African Sovereigns and African Central Banks

____________________________________________________________________________________________________________________________

_______________________________________________________________________

FUND ARRANGERS AND TRANSACTION ADVISORS FOR INVESTMENT GRADE CORPORATES IN SPECIFICALLY NIGERIA AND SELECTED COUNTRIES ACROSS THE AFRICA REGION : bank debt/ senior loans, second-lien debt, uni tranche debt, mezzanine debt and structured equity for a variety of situations, including growth capital, acquisition financing, refinancing , repricing's, dividend recapitalizations | special situations | Investment grade corporations | African Sovereigns and African Central Banks

____________________________________________________________________________________________________________________________

______________________________________

BRITISH FINANCIAL SERVICES FIRM

______________________________________

CLEMENTAGHAYERE [ BRITISH FOUNDING PARTNER]

Partner/ Managing Partner/ Managing Director |

PORTFOLIO AFRICA EQUATES : USD 30BN, AUM.

[ Executive - level ] British Banker Clement Aghayere Ex Barclays PLC , city of London Anti - money laundering division | Globally acknowledged as UK most accomplished emerging markets Africa Investment banker | Former Co- founder Emerging markets merchant Bank Brigg Capital Mayfair London CIB : Corporate banker and Investment banker [ EMEA and APAC incl Japan ] Protege Dr Rilwanu Lukman former President OPEC , Vienna Austria | British educated : British Born, private school educated | Landed gentry Benin Kingdom Nigeria | Political economist and corporate strategist | Ex Credit Lyonnais | Mitsu Bussan commodities London | senior WAF crude oil trader European oil and Gas trading company based in Amsterdam | Microsoft systems engineer, M.C.S.E .Lan and Wan networks Amsterdam | Clement Aghayere has been appointed since October 2015 as a senior consultant [ Executive - level, Global Head origination ] corporate origination Africa at Bank of China BANK OF CHINA GROUP LIMITED | 中国银行股份有限公司 | one of the most respected Banks in the World MARKET CAP $1.41 TRILLION

______________________________________________________________________________________________________________________________________________

Partner/ Managing Partner/ Managing Director |

PORTFOLIO AFRICA EQUATES : USD 30BN, AUM.

[ Executive - level ] British Banker Clement Aghayere Ex Barclays PLC , city of London Anti - money laundering division | Globally acknowledged as UK most accomplished emerging markets Africa Investment banker | Former Co- founder Emerging markets merchant Bank Brigg Capital Mayfair London CIB : Corporate banker and Investment banker [ EMEA and APAC incl Japan ] Protege Dr Rilwanu Lukman former President OPEC , Vienna Austria | British educated : British Born, private school educated | Landed gentry Benin Kingdom Nigeria | Political economist and corporate strategist | Ex Credit Lyonnais | Mitsu Bussan commodities London | senior WAF crude oil trader European oil and Gas trading company based in Amsterdam | Microsoft systems engineer, M.C.S.E .Lan and Wan networks Amsterdam | Clement Aghayere has been appointed since October 2015 as a senior consultant [ Executive - level, Global Head origination ] corporate origination Africa at Bank of China BANK OF CHINA GROUP LIMITED | 中国银行股份有限公司 | one of the most respected Banks in the World MARKET CAP $1.41 TRILLION

______________________________________________________________________________________________________________________________________________

______________________________________________________________________________________________________________________________

LONDON INVESTORS SHOW 2022

https://www.londoninvestorshow.com/speakers-2022 [ click here]

www.londoninvestorshow.com/clement-aghayere [ click here]

THEME OF THE LONDON SESSION: THE STATE OF THE UK ECONOMY TODAY [ 2022

____________________________________________________________________________________________________________________________________________

British banker Clement Aghayere is one of the most influential British finance figure's on the continent of Africa | British banker former co - founder emerging markets merchant bank Mayfair London Briggcapital renamed BriggMacadam Investment bank London | city of London investment banker stems from one of the most successful banking & finance families largest economy Africa | founders banking sector Nigeria

_____________________________________________________________________________________________________________________________________________

LONDON INVESTORS SHOW 2022

https://www.londoninvestorshow.com/speakers-2022 [ click here]

www.londoninvestorshow.com/clement-aghayere [ click here]

THEME OF THE LONDON SESSION: THE STATE OF THE UK ECONOMY TODAY [ 2022

____________________________________________________________________________________________________________________________________________

British banker Clement Aghayere is one of the most influential British finance figure's on the continent of Africa | British banker former co - founder emerging markets merchant bank Mayfair London Briggcapital renamed BriggMacadam Investment bank London | city of London investment banker stems from one of the most successful banking & finance families largest economy Africa | founders banking sector Nigeria

_____________________________________________________________________________________________________________________________________________

CLEMENT AGHAYERE CEO | successfully closed USD 315M loans | and secured agreements in principle - USD 30BN, AUM - for Nigeria & Africa.

CLEMENTAGHAYERE CEO | is responsible for the largest debt capital raise in history of the largest economy in Africa, a $7bn credit facility [ EOI]

British born, private school educated banker is the most successful emerging markets Africa banker in the world, based in the city London . UK,

CLEMENT AGHAYERE CEO | is responsible for Bank of China, Johannesburg, South Africa first financial institution transaction on the continent of Africa, outside of South Africa, a $300million Bi - Lateral loan transaction with The No1 preferred credit status Africa |AFREXIM BANK EGYPT |

CLEMENT AGHAYERE BRITISH CHAIRMAN successfully closed $ 315M loans | secured agreements in principle USD 30BN, AUM - for Nigeria.

____________________________________________________________________________________________________________________________

CLEMENTAGHAYERE CEO | is responsible for the largest debt capital raise in history of the largest economy in Africa, a $7bn credit facility [ EOI]

British born, private school educated banker is the most successful emerging markets Africa banker in the world, based in the city London . UK,

CLEMENT AGHAYERE CEO | is responsible for Bank of China, Johannesburg, South Africa first financial institution transaction on the continent of Africa, outside of South Africa, a $300million Bi - Lateral loan transaction with The No1 preferred credit status Africa |AFREXIM BANK EGYPT |

CLEMENT AGHAYERE BRITISH CHAIRMAN successfully closed $ 315M loans | secured agreements in principle USD 30BN, AUM - for Nigeria.

____________________________________________________________________________________________________________________________

- The Aghayere family are one of the Worlds most successful Africa - focused Banking and finance families based in the city of London

_____________________________________________________________________________________________________________________________________________

GLOBAL SENIOR MANAGEMENT TEAM | CITY OF LONDON UK GLOBAL HEAD OFFICE .

_____________________________________________________________________________________________________________________________________________

1. British Founder , British Executive chairman and CEO Clement Aghayere [ Former Barclays Bank PLC ,UK City of London ]

- co founder | Partner | Senior Vice President for Africa at Emerging markets Merchant Bank Brigg Capital Mayfair London , The United Kingdom .

exclusively mandated as the preferred corporate origination partner Africa by The third largest bank in the world and the oldest Bank

in The Peoples Republic of China THE BANK OF CHINA LIMITED | 中国银行股份有限公司 - one of the most respected Banks in the World

2. Taiwo Onitiri , Director Msc Partner and Senior Vice President corporate origination Nigeria [ Former Standard Chartered Bank Nigeria ]

3. Srihari Belur , Executive Director Strategic partner corporate origination Africa

[ Ex -state bnk of India ,partner of the top 5% management team [ S.I.B ]

4. Jack Munt , BA Vice President Global Partnerships and Institutional management

5. Nicole Njoku , MA VP client relations APAC [ Mandarin Speaker ]

6. Yele Fafowora , Msc Vice President Shipping Division West Africa coverage

7. Caleb Gibbons , MBA Senior Vice President Debt capital markets Japan

8. Femi Odumabo Director | Msc , Senior Advisor [ Oil and Gas Advisory ] Former Chairman Chevron Nigeria for Africa and Latin America

9. George Seftelis , MBA , Senior Vice President , Leveraged and structure finance Former Afrexim Bank reporting to the President ]

10. Sajid Shaikh Ex Mashreq Bank | ICICI Bank | CITI Bank | Standard Chartered Bank | Chief Manager Trade Finance officer

Lead Trade finance origination Africa bridge capital management City of London UK Global head office .

_____________________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________________________________

GLOBAL SENIOR MANAGEMENT TEAM | CITY OF LONDON UK GLOBAL HEAD OFFICE .

_____________________________________________________________________________________________________________________________________________

1. British Founder , British Executive chairman and CEO Clement Aghayere [ Former Barclays Bank PLC ,UK City of London ]

- co founder | Partner | Senior Vice President for Africa at Emerging markets Merchant Bank Brigg Capital Mayfair London , The United Kingdom .

exclusively mandated as the preferred corporate origination partner Africa by The third largest bank in the world and the oldest Bank

in The Peoples Republic of China THE BANK OF CHINA LIMITED | 中国银行股份有限公司 - one of the most respected Banks in the World

2. Taiwo Onitiri , Director Msc Partner and Senior Vice President corporate origination Nigeria [ Former Standard Chartered Bank Nigeria ]

3. Srihari Belur , Executive Director Strategic partner corporate origination Africa

[ Ex -state bnk of India ,partner of the top 5% management team [ S.I.B ]

4. Jack Munt , BA Vice President Global Partnerships and Institutional management

5. Nicole Njoku , MA VP client relations APAC [ Mandarin Speaker ]

6. Yele Fafowora , Msc Vice President Shipping Division West Africa coverage

7. Caleb Gibbons , MBA Senior Vice President Debt capital markets Japan

8. Femi Odumabo Director | Msc , Senior Advisor [ Oil and Gas Advisory ] Former Chairman Chevron Nigeria for Africa and Latin America

9. George Seftelis , MBA , Senior Vice President , Leveraged and structure finance Former Afrexim Bank reporting to the President ]

10. Sajid Shaikh Ex Mashreq Bank | ICICI Bank | CITI Bank | Standard Chartered Bank | Chief Manager Trade Finance officer

Lead Trade finance origination Africa bridge capital management City of London UK Global head office .

_____________________________________________________________________________________________________________________________

Your browser does not support viewing this document. Click here to download the document.

______________________________________________________________________________________________________________________________

BRITISH FINANCIAL SERVICES FIRM: AFRICA BRIDGE CAPITAL MANAGEMENT LONDON UK LIMITED |

~ Preferred corporate Partner /s and JV partners [ affiliates and associates]

1, Bank of China | Please click on link : 中国银行全球服务 Always with you @ 英国 United Kingdom (bankofchina.com)

2. Torino Capital New York [ Finra regulated, emerging markets Investment bank | Please click on link: Torino Capital, LLC

3. Batsela asset management Paris, France | Please click on link: www.bhgroup.eu

4. AFREXIM bank Cairo Egypt

5 . Bank of Industry Nigeria subsidiary - BOITC, Lagos Nigeria

6 . ECOWAS Bank of Investment and development EBID, Lome Togo

7. PAC Capital Lagos Nigeria

8. SATAREM ,Paris France | USD 1Billion renewble energy projects portfolio [ Africa coverage ]

BRITISH FINANCIAL SERVICES FIRM: AFRICA BRIDGE CAPITAL MANAGEMENT LONDON UK LIMITED |

~ Preferred corporate Partner /s and JV partners [ affiliates and associates]

1, Bank of China | Please click on link : 中国银行全球服务 Always with you @ 英国 United Kingdom (bankofchina.com)

2. Torino Capital New York [ Finra regulated, emerging markets Investment bank | Please click on link: Torino Capital, LLC

3. Batsela asset management Paris, France | Please click on link: www.bhgroup.eu

4. AFREXIM bank Cairo Egypt

5 . Bank of Industry Nigeria subsidiary - BOITC, Lagos Nigeria

6 . ECOWAS Bank of Investment and development EBID, Lome Togo

7. PAC Capital Lagos Nigeria

8. SATAREM ,Paris France | USD 1Billion renewble energy projects portfolio [ Africa coverage ]

______________________________________________________________________________________________

LONDON INVESTORS SHOW 2022

https://www.londoninvestorshow.com/speakers-2022

www.londoninvestorshow.com/clement-aghayere

REUTERS REPORTS 2022 | EXCLUSIVE Shell's Nigerian oil assets attract interest from local firms, sources say

https://www.reuters.com/markets/europe/exclusive-shells-nigerian-oil-assets-attract-interest-local-firms-sources-say-2022-01-06/ [ Click here ]

File Photo Above : Founding Partner Mr Clement Aghayere | Executive Chairman and CEO , Africa Bridge capital management London UK Limited and The Former President of Nigeria his excellency Chief Olusegun Obasanjo both attending the African Investment summit Savoy London | British Banker Clement Aghayere since in the inception of his firm has raised an estimated $30bn for Nigeria agreements in principle and closed $ 300million | Globally acknowledged as the most successful emerging markets , Africa focused Investment banker city of London

LONDON INVESTORS SHOW 2022

https://www.londoninvestorshow.com/speakers-2022

www.londoninvestorshow.com/clement-aghayere

REUTERS REPORTS 2022 | EXCLUSIVE Shell's Nigerian oil assets attract interest from local firms, sources say

https://www.reuters.com/markets/europe/exclusive-shells-nigerian-oil-assets-attract-interest-local-firms-sources-say-2022-01-06/ [ Click here ]

File Photo Above : Founding Partner Mr Clement Aghayere | Executive Chairman and CEO , Africa Bridge capital management London UK Limited and The Former President of Nigeria his excellency Chief Olusegun Obasanjo both attending the African Investment summit Savoy London | British Banker Clement Aghayere since in the inception of his firm has raised an estimated $30bn for Nigeria agreements in principle and closed $ 300million | Globally acknowledged as the most successful emerging markets , Africa focused Investment banker city of London

______________________________________

EMERGING MARKETS

INVESTMENT BANKING LONDON .

______________________________________

______________________________________

BRITISH FINANCIAL SERVICES FIRM

DIDITIZING THE AFRICAN INVESTMENT ECOSYSTEM LONDON.

______________________________________

|

# [ BRITISH EXECUTIVE CHAIRMAN] MR CLEMENT AGHAYERE | Global Chair SSA , (Group head Africa Coverage and CEEMA sovereign DCM) at Africa bridge capital management London [ UK] Ltd - PORTFOLIO AFRICA EQUATES: USD 30BN, AUM - British by Birth, super star emerging markets, Africa focused investment banker Clement Aghayere Chairman and CEO, Africa Bridge capital Management London has been globally acknowledged as the city of London most successful emerging markets banker and subsequently most accomplished Africa focused banker in the world | British Banker family members and founders Mayo associates Lagos Nigeria, are widely acknowledged as founders Banking sector of the largest economy in Africa |

_____________________________________________________________________________________________________________________________________________

Globally, acknowledged as the city of London most successful emerging markets, Africa focused banker | BRITISH FOUNDER MR C. AGHAYERE

CLEMENT AGHAYERE BRITISH CHAIRMAN successfully closed $ 315M loans | secured agreements in principle USD 30BN, AUM - for Nigeria.

British by Birth, city of London emerging markets Investment banker formative years attended princess May Junior school North London N. 16.

_____________________________________________________________________________________________________________________________________________

Globally, acknowledged as the city of London most successful emerging markets, Africa focused banker | BRITISH FOUNDER MR C. AGHAYERE

CLEMENT AGHAYERE BRITISH CHAIRMAN successfully closed $ 315M loans | secured agreements in principle USD 30BN, AUM - for Nigeria.

British by Birth, city of London emerging markets Investment banker formative years attended princess May Junior school North London N. 16.

_____________________________________________________________________________________________________________________________________________

_______________________________________________________________________________________________

About AFRICA BRIDGE CAPITAL MANGEMENT LONDON UK LIMITED

We are a UK based financial services and Boutique Investment banking and corporate finance Advisory Firm London and offer a wide financial services partnered with investment Funds such as AFREXIM Bank , Bank of China and Bank of Industry Nigeria subsidiary - BOITC partnered with a Global distribution company affiliated with 480 Africa focused Global investors | Digitizing the African investment ecosystem city of LondonUK

_____________________________________________________________________________________________________________________________________________

About AFRICA BRIDGE CAPITAL MANGEMENT LONDON UK LIMITED

We are a UK based financial services and Boutique Investment banking and corporate finance Advisory Firm London and offer a wide financial services partnered with investment Funds such as AFREXIM Bank , Bank of China and Bank of Industry Nigeria subsidiary - BOITC partnered with a Global distribution company affiliated with 480 Africa focused Global investors | Digitizing the African investment ecosystem city of LondonUK

_____________________________________________________________________________________________________________________________________________

______________________________________

CITY OF LONDON

LONDON THE UNITED KINGDOM

______________________________________

AFRICA BRIDGE CAPITAL MANAGEMENT LONDON [ UK ] LIMITED and Partner DFIs Collaborate to Bolster Infrastructure Development across the continent of Africa .

______________________________________________________________________________________________________________________________________________

Africa Bridge Capital Management London the United kingdom | British Financial Services Firm | Debt / Structured Finance within Investment Banking and Financial Services within Financial Services in London

Keywords: British Financial Services

Sector: Banking & British Financial Services

Location: London

Chairman and CEO : Clement Aghayere

Industry Name: British Financial Services

______________________________________________________________________________________________________________________________________________

Africa Bridge Capital Management London the United kingdom | British Financial Services Firm | Debt / Structured Finance within Investment Banking and Financial Services within Financial Services in London

Keywords: British Financial Services

Sector: Banking & British Financial Services

Location: London

Chairman and CEO : Clement Aghayere

Industry Name: British Financial Services

______________________________________

BRITISH BANKER

CLEMENT AGHAYERE

PORTFOLIO AFRICA USD 30BN

______________________________________

_____________________________________________________________________________________________________________________________________________

~ Exclusive interview British Banker Ex Barclays Bank PLC Clement Aghayere , The UK , most accomplished Africa -focused Investment banker based in the city of London| Clement has raised tens of billions of united states dollars for the sovereign Nigeria [ commitments in principle ]

_____________________________________________________________________________________________________________________________________________

~ Exclusive interview British Banker Ex Barclays Bank PLC Clement Aghayere , The UK , most accomplished Africa -focused Investment banker based in the city of London| Clement has raised tens of billions of united states dollars for the sovereign Nigeria [ commitments in principle ]

_____________________________________________________________________________________________________________________________________________

______________________________________

BRITISH BANKER EX BARCLAYS PLC

CLEMENT AGHAYERE

PORTFOLIO AFRICA : $30BN

______________________________________